Texas Veterans Benefits: Your Comprehensive 2025 Guide to Disabled Veterans Benefits in Texas

Why Texas Leads the Nation in Supporting Veterans

Texas is home to nearly 1.4 million veterans—the second-largest veteran population in the United States—and the Texas Legislature has steadily expanded state-level benefits to complement federal VA programs. From full property-tax exemptions for 100 percent disabled veterans to tuition-free college hours under the Hazlewood Act, the Lone Star State offers one of the most generous packages in the country.

Who Is Eligible for Texas Veterans Benefits?

You may qualify for Texas veterans benefits if you:

- Entered military service in Texas, were a Texas resident at enlistment, or have claimed Texas as your home of record.

- Received an honorable discharge (general under honorable is accepted for many programs).

- Meet service-specific criteria—for example, 181 days of active duty for the Hazlewood tuition exemption.

Many programs extend to spouses, surviving spouses, and dependent children, especially when the veteran is service-connected disabled, missing in action, or deceased.

Property Tax Relief for Disabled Veterans in Texas

Standard Disabled Veteran Exemption

| VA Disability Rating | 2025 Exemption Amount* |

|---|---|

| 10 – 29 % | $5,000 |

| 30 – 49 % | $7,500 |

| 50 – 69 % | $10,000 |

| 70 – 99 % | $12,000 |

| 100 % (or unemployability) | Full exemption |

*Applied to the appraised value of your residence homestead.

Homestead 100 % Disabled Veteran Exemption

Veterans rated 100 percent service-connected owe no property taxes on their primary residence—an immediate savings that often tops $6,000 a year in high-value counties. Surviving spouses keep the exemption if they remain in the home and do not remarry.

Veterans who are seniors may also benefit from Texas’s Senior Tax Ceiling / Property Tax Freeze, which locks in the school portion of property taxes at the amount paid in the year they turned 65 (or for those qualifying via disability). For more on how that works, check out our 2025 guide to the Property Tax Freeze for Seniors in Texas.

Pending 2025 Legislation

A 2025 bill (HB 4321) proposes switching the flat-dollar exemptions above 10 percent to percentage-based tax relief, further boosting savings for lower-income veterans if adopted.

Education Advantages: The Hazlewood Act & More

The Hazlewood Act provides up to 150 semester credit hours of tuition exemption at public Texas colleges or universities—after federal GI Bill benefits run out or in lieu of them. Spouses and children may receive unused hours through the Legacy Program (child must begin before age 26).

Other education perks:

- College Credit for Military Experience—state universities must consider your MOS/AFSC for credit awards.

- Tutoring and Certification Testing Vouchers via the Texas Veterans Commission (TVC).

Tuition savings can exceed $50,000 on a four-year degree at flagship campuses—an investment that pays lifelong dividends.

Housing & Homeownership Benefits for Texas Veterans

Veterans Land Board (VLB) Loans

| Program | 2025 Loan Cap | Base Interest Rate | Notes |

|---|---|---|---|

| Home Loan | $806,500 | 6.2 % | Little-to-no down payment; extra 0.5 % discount for ≥30 % disabled veterans |

| Land Loan | $150,000 | 7.25 % | 5 % down, 30-year term |

| Home Improvement Loan | $50,000 | discounted for ≥30 % SC | Finance energy-efficiency, ADA upgrades |

State Veterans Homes & Cemeteries

The VLB runs nine skilled-nursing “Texas State Veterans Homes” and four veterans cemeteries, offering cost-effective long-term care and dignified burial options. Veterans exploring broader senior living options may also find value in our complete 2025 guide to retirement homes in Texas.

Health & Mental Health Care Resources

Alongside federal VA hospitals in Houston, San Antonio, Dallas, Temple, and El Paso, the Texas Veterans Commission’s Veterans Mental Health Department (VMHD) coordinates statewide peer-to-peer networks, suicide-prevention training, and justice-involved veteran outreach—all free of charge regardless of discharge status.

New 2025 legislation would also make Texas the first state to track veteran suicides independently, steering $50 million into clinical trials of alternative therapies such as ibogaine.

Employment, Training & Entrepreneurship

- State Hiring Preference—all Texas agencies must interview qualified veterans first and choose the veteran when finalists are equal.

- Texas Workforce Commission “Skills for Transition” offers résumé help and priority access to job fairs.

- Veteran Entrepreneur Program (VEP)—business plan workshops and micro-loans up to $20,000 for start-ups.

Financial Assistance & Grant Programs

The Fund for Veterans’ Assistance (FVA)—administered by TVC—awards $50 million+ annually to nonprofits and local governments that provide rent, utility, and emergency-cash help to veterans and their families. You can learn more or apply at Support Texas Veterans Grants via the Texas Veterans Commission.”

Recreation & Quality-of-Life Perks

- Disabled Veteran Super Combo Hunting & Fishing License—zero cost for veterans with ≥50 % disability or the loss of a limb.

- State Parklands Passport—free entry to all Texas state parks for veterans with ≥60 % service-connected disability.

- Discounted Camping & Public Hunting Permits and a growing digital license option rolling out August 15 2025.

Additional Disabled Veterans Benefits Texas Offers

- Disabled Veteran (DV) License Plates—$3 specialty plate fee with waived annual registration; opt-in version with the International Symbol of Access (ISA) provides disabled-parking privileges statewide.

- No Fee for Driver’s License renewals when marked “Veteran.”

- Priority Seating & Security Screening at many county courthouses and airports.

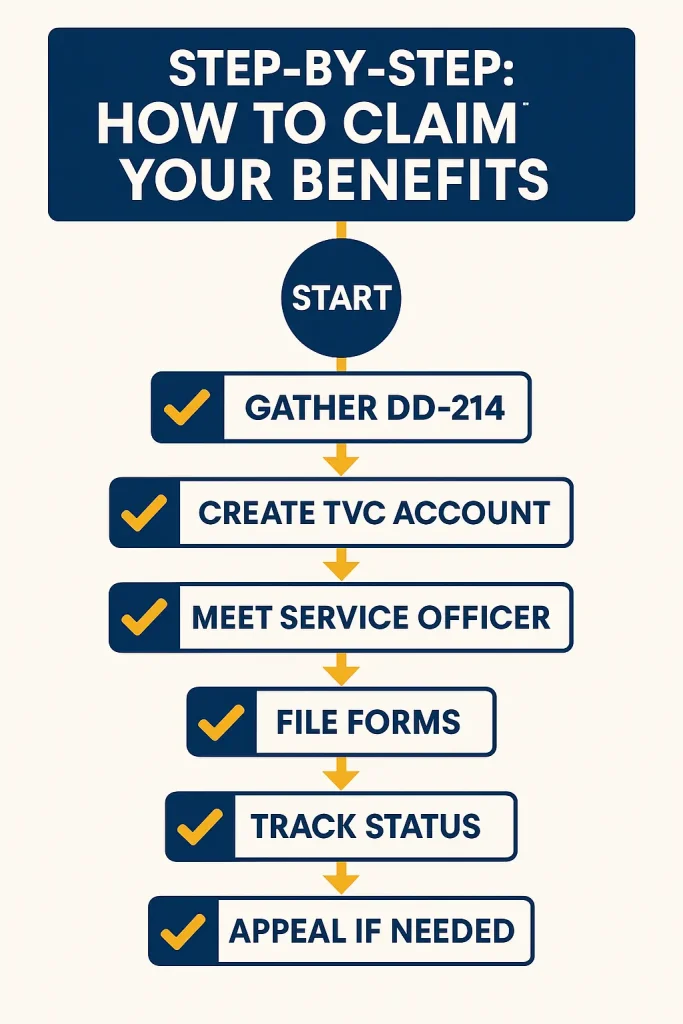

Step-by-Step: How to Claim Your Texas Veterans Benefits

- Gather Proof of Service—DD-214 Member 4 copy or VA award letter.

- Create an eBenefits & TVC Account to manage claims online.

- Meet With a TVC Service Officer (free) for claims coaching.

- File the Appropriate State Forms—e.g., Form 50-135 for property-tax exemptions, TVC-ED-1 for Hazlewood.

- Track Your Application—most state exemptions activate on January 1 following approval; tuition benefits apply the next semester.

- Appeal or Re-file if Needed within statutory deadlines (usually five years for property tax).

Texas Veterans Benefits FAQ

| Question | At-a-Glance Answer |

|---|---|

| Can I combine Hazlewood with the Post-9/11 GI Bill? | Yes. Use the GI Bill first; Hazlewood covers any tuition left after federal benefits are exhausted. |

| Does the tax exemption apply to a second home? | No. Only your principal residence homestead qualifies. |

| Are National Guard members eligible? | If you were federalized under Title 10 for at least 181 days, you qualify for most benefits. |

| Can I get a VLB home loan outside Texas? | No, the property must be within Texas and your primary residence. |

| What if I move out of state? | You may lose state-only benefits, but federal VA benefits follow you. Selling a Texas or New Jersey property? We can help—see below. For a full breakdown of what to expect when moving across state lines, see our Moving From New Jersey to Texas: Tips & Insights guide. |

Final Thoughts—And a Fast, No-Stress Way to Access Your Home Equity

Whether you’re a first-term sailor or a 100 percent disabled retiree, Texas veterans benefits and disabled veterans benefits Texas deliver tangible savings on housing, education, and quality-of-life costs. If life changes have you relocating to or from New Jersey—and you need to unlock your home equity quickly—our family-run team at IWillBuyYourHouseForCash.com can purchase your house as-is, with no commissions or closing costs. Explore our process here: How We Buy Houses. It’s the same stress-free service fellow veterans in our testimonials rave about—because you deserve nothing less.