How Sellers Receive Cash After Closing

When selling a home, you get paid after closing once all sale-related expenses (like agent commissions and taxes) are deducted. These remaining funds, called net proceeds, are typically sent to you through wire transfer or cashier’s check. Here’s what you need to know:

- Wire Transfers: Funds are sent electronically to your bank account, usually arriving within 1–3 business days. Timing depends on banking hours, holidays, and transfer systems.

- Cashier’s Checks: A secure option drawn from the bank’s funds. You’ll need to deposit it, with funds typically available within 1–2 business days.

Factors like incorrect banking details, large transaction reviews, or missing paperwork can cause delays. Fraud risks, such as wire fraud, are another concern (ALTA on wire fraud).

To avoid issues:

- Double-check your account information.

- Communicate with your closing agent in advance.

- Review your purchase agreement for payment terms.

For a faster, hassle-free process, cash buyers like I Will Buy Your House For Cash simplify payments, often avoiding delays tied to financing or contingencies.

When Will I Be Paid From A House Sale?

Payment Methods for Sellers

When your property sale is finalized, you’ll receive your proceeds through one of two options: wire transfers or cashier’s checks. Here’s a quick breakdown of how each works:

Wire Transfers

This method electronically deposits the funds directly into your bank account. To set up a wire transfer, you’ll need to provide your closing agent with important banking details like your bank’s routing number and account number. Processing times can differ depending on the bank and the timing of the transfer.

Cashier’s Checks

For high-value transactions, a cashier’s check is another secure option. These checks are drawn directly from the bank’s funds, ensuring reliable and immediate payment.

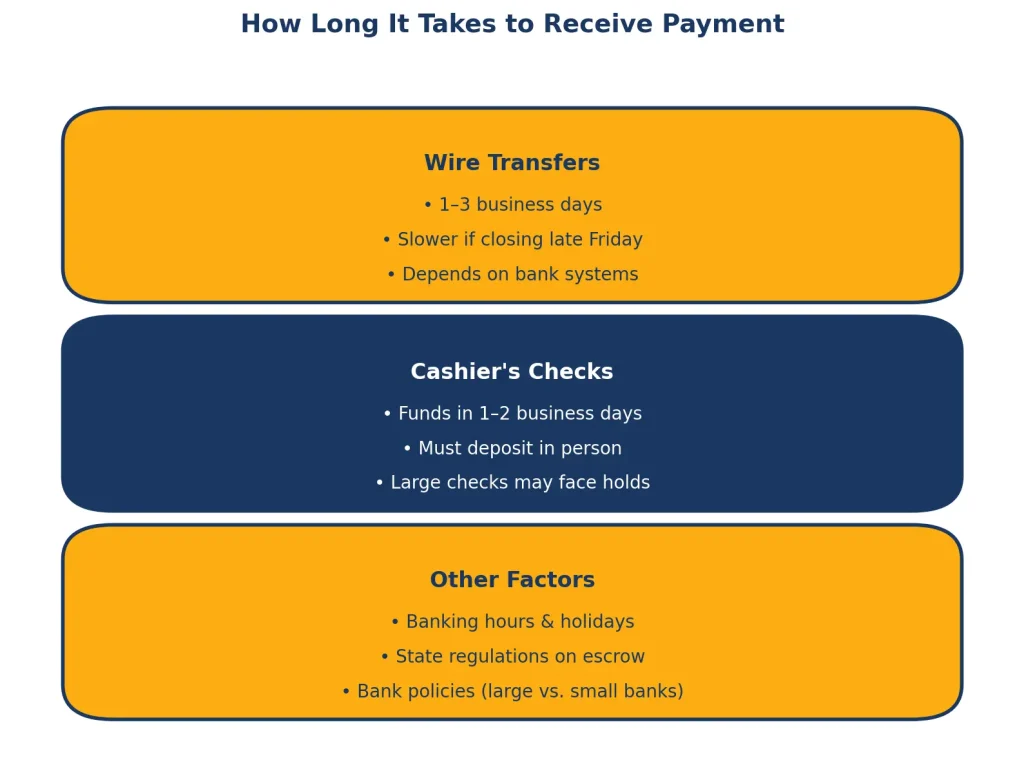

How Long It Takes to Receive Payment

How quickly you get paid depends on the payment method and a few other factors, but most sellers see their funds within a few business days after closing. The exact timing can vary based on the method you choose and specific circumstances surrounding the transaction.

Typical Payment Timelines

- Wire transfers: These generally take 1 to 3 business days to show up in your account after closing. For example, if your closing happens late on a Friday, the funds might not arrive until the following Tuesday or Wednesday. The speed can also depend on whether your bank and the sender’s bank use the same wire processing systems.

- Cashier’s checks: These provide quicker access but require you to visit your bank to deposit or cash them. Most banks make these funds available within 1 to 2 business days, though deposits over $10,000 might face longer holds depending on your bank’s policies.

The day of the week you close also matters. Closings that happen between Tuesday and Thursday usually lead to faster payments, while Friday closings often mean waiting until the next week for funds to process.

What Affects Payment Speed

Several factors can either speed up or slow down the process:

- Banking hours and holidays: Transfers initiated after 2:00 PM are processed the next business day. Additionally, federal holidays like Memorial Day or Labor Day can add extra wait time.

- State regulations: Some states have rules requiring extra documentation or specific escrow fund disbursement procedures, which can extend the timeline by an extra day or two.

- Bank policies: Larger banks, such as Chase or Bank of America, often process wires faster than smaller community banks or credit unions, which may have fewer processing windows.

Common Delays and How to Prevent Them

While most payments are processed smoothly, certain issues can cause delays. Here’s what to watch for:

- Incorrect banking information: Mistakes in your account or routing numbers, or even a mismatch in the account name, can lead to payment rejections. Double-check all details before sharing them with your closing agent. Errors like this can add 2 to 5 extra business days for reprocessing.

- Large transaction holds: Banks sometimes flag large deposits (e.g., over $50,000) for security reviews. To avoid delays, notify your bank ahead of time if you’re expecting a significant transfer.

- Incomplete paperwork: Missing signatures or documentation can stall the entire process. Make sure all closing documents are signed and notarized before leaving the closing table. Incomplete forms may require additional appointments, delaying your payment by several days.

To avoid these hiccups, always provide your banking details in writing, confirm everything with your closing agent ahead of time, and stay in touch with both your bank and the closing agent throughout the process. A little preparation goes a long way in ensuring a smooth and timely payment.

How to Get Your Payment Quickly

Getting your money quickly after closing requires a bit of preparation and staying involved throughout the process. Sellers who take the time to plan ahead and stay informed often experience fewer delays when it’s time to receive their funds.

Once you’ve chosen your preferred payment method, take these steps to help speed things along.

Double-Check Your Information

Accurate banking details are essential for a smooth payment process. Even a small mistake in your account information can lead to delays.

Make sure to provide your full legal name exactly as it appears on your bank account, along with the correct account and routing numbers. Double-check these numbers against your checks or confirm them with your bank. If you’ve recently switched accounts, it’s a good idea to contact your bank to verify everything is up to date. Some banks use multiple routing numbers, so confirm which one applies to your account to avoid any hiccups.

If you’re opting for a cashier’s check, ensure the closing agent has your name and address spelled correctly. Even minor errors on a cashier’s check can trigger additional verification steps, which could slow things down.

Stay in Touch with Your Closing Agent

Your closing agent or escrow company is a key player in the payment process. Reach out to them at least a week before closing to go over the details of how and when funds will be disbursed.

While most title companies follow standard timelines, they might be able to expedite the process if you communicate your needs early. For instance, ask when they typically initiate wire transfers – many send them early in the day to allow for same-day processing. Be sure to get your closing agent’s direct contact information, so you can easily follow up if needed.

Request to be notified as soon as the transfer is initiated and ask for the wire confirmation number to track the transaction.

If you’re working with a cash buyer like I Will Buy Your House For Cash, the process can be even simpler. Their team handles much of the coordination and ensures clear communication throughout the closing, which can help minimize delays and keep things moving smoothly.

Check Your Purchase Agreement

Take a close look at your purchase agreement to understand the terms around fund disbursement.

Some agreements specify that payments will be released a day or two after closing instead of immediately. If that’s the case, plan accordingly and don’t expect same-day payment.

Also, watch for contingencies that could impact the timing of your payment. For example, if the buyer is using financing, the agreement might require final lender approval before funds are released. On the other hand, cash sales typically avoid these kinds of delays, making the process faster.

Lastly, review the breakdown of closing costs to know exactly how much you should receive. Being clear on this upfront can help you quickly spot any discrepancies when the payment arrives. If something doesn’t look right, address it with your closing agent before the process is finalized.

You might also be interested to see what are some inherited property challenges.

sbb-itb-293278e

Wire Transfers vs. Cashier’s Checks

When it comes to receiving proceeds, sellers often have two main options: wire transfers or cashier’s checks. Each has its own perks and drawbacks, and choosing the right one depends on your priorities – whether it’s speed, security, or convenience. Here’s a closer look at how these two methods stack up.

Wire Transfer Pros and Cons

Wire transfers are a popular choice for large transactions in real estate, especially with title companies, because they’re both fast and reliable.

Why Wire Transfers Work Well

Speed: Funds usually arrive within a few hours or by the next business day.

Security: Money moves directly between banks through secure channels.

Finality: Once initiated, a wire transfer is irreversible, which helps protect against fraud.

Things to Keep in Mind

While wire transfers are convenient, they do have some drawbacks:

Bank Fees: Most banks charge a fee for sending or receiving a wire.

Fraud Risk: Rare but possible if sensitive banking details are compromised.

The good news? Working with a trusted title company greatly reduces these risks, ensuring your money is transferred safely and efficiently.

Cashier’s Check Pros and Cons

Cashier’s checks are a more traditional payment method that some sellers still prefer. Since they’re guaranteed by the bank, they won’t bounce, making them a safe way to receive funds.

Advantages of Cashier’s Checks

Secure: Guaranteed by the issuing bank.

Privacy: No need to share sensitive banking details electronically.

Low or No Fees: Most banks issue or accept them without extra charges.

Drawbacks of Cashier’s Checks

Clearing Time: Deposits can take 1–3 business days to clear.

Risk of Loss: Checks can be lost, stolen, or damaged.

Possible Holds: Banks may place holds on large checks, delaying access to funds.

While cashier’s checks are safe, the slower processing time and potential risks make them less convenient than wire transfers for many real estate closings.

Side-by-Side Comparison

| Aspect | Wire Transfer | Cashier’s Check |

|---|---|---|

| Speed | Immediate to next business day | 1–3 business days |

| Security | Highly secure and irreversible | Guaranteed by bank; physical risks |

| Fees | Bank fees may apply | Usually no fees |

| Convenience | Funds appear directly in your account | Requires a bank deposit |

| Industry Preference | Required by many title companies | Often used for smaller transactions |

| Risk Factors | Electronic fraud (rare) | Potential loss, theft, or damage |

Wire transfers tend to be the go-to option for their speed and reliability, especially for larger sums. Many title companies even require them for closing transactions. However, cashier’s checks can still be a good choice for those who prefer a more traditional approach or want to avoid sharing banking details.

Ultimately, the right choice depends on your comfort level with technology, how quickly you need access to your funds, and any specific requirements set by your title company.

How I Will Buy Your House For Cash Makes It Simple

Selling a house the traditional way can be stressful and full of delays. But when you work with I Will Buy Your House For Cash, based in Cranford, NJ, the process becomes much smoother. They’ve designed a system that makes getting your cash payment easy and hassle-free.

Here’s why their approach stands out:

Straightforward Cash Offers Without the Hassle

One major perk of working with I Will Buy Your House For Cash is their simple, all-cash offer process. Unlike traditional sales that often get bogged down by financing issues, their method removes those complications entirely.

With no need for repairs, cleaning, agent fees, or even closing costs, the process is not only faster but also more transparent. You’ll know exactly how much money you’re getting and when you’ll receive it. Plus, they buy homes as-is, so you don’t have to worry about fixing anything.

Flexible Closing Dates to Fit Your Needs

Timing can make or break a home sale, and I Will Buy Your House For Cash understands that. They offer closing dates that work around your schedule. Whether you need to close quickly to resolve financial concerns or prefer a little extra time to organize your move, they’ll adjust to your timeline.

This flexibility allows you to avoid the rigid schedules often dictated by mortgage lenders in traditional sales. Instead, you can plan ahead with peace of mind, knowing exactly what to expect.

A Commitment to Customer Care

Selling a home can be overwhelming, but I Will Buy Your House For Cash prioritizes customer service to make the experience as smooth as possible. As a family-owned business, they value integrity and treat each client as more than just another transaction.

Their process is clear and transparent from start to finish. They take the time to explain your cash offer and provide ongoing support, so you’re never left wondering what’s happening. This personal touch helps take the stress out of selling your home and ensures you feel confident every step of the way.

Summary

Getting a handle on your post-closing cash receipt process can make planning easier and cut down on stress. Here’s a breakdown of the essentials and why a smooth process matters.

Main Points to Keep in Mind

- Decide between fast wire transfers or secure cashier’s checks based on your preference.

- Payments typically arrive within 1–3 business days, but the exact timing can vary. Double-check your banking details, stay in touch with your agent, and review your agreement to avoid any hiccups.

- Being prepared ahead of time helps prevent unnecessary delays and keeps everything running smoothly.

Why a Simple Process Matters

A simplified sale process comes with its perks. For example, I Will Buy Your House For Cash removes the usual headaches of traditional sales. Their no-fuss approach eliminates financing delays and offers clear, predictable payment timelines. Whether you’re moving, downsizing, or navigating a tough situation, knowing exactly when to expect your payment can make all the difference. It’s all about making the process as stress-free as possible.

FAQs

How can I ensure a smooth wire transfer after closing?

To make sure your wire transfer goes off without a hitch after closing, start by obtaining the wiring instructions directly from your title company or closing agent. Always verify these instructions over the phone to protect yourself from fraud. Take the time to carefully double-check every detail before initiating the transfer.

It’s smart to initiate the wire transfer at least 24 hours before your scheduled closing appointment. This helps avoid any last-minute delays. Once you’ve sent the transfer, confirm with your bank and follow up to ensure the funds are received within 24 to 48 hours. To stay safe, never share sensitive details, like wire instructions, through email, as it can expose you to scams.

What’s the difference between receiving funds via wire transfer or cashier’s check after closing?

When it comes to transferring funds, wire transfers are generally the quickest option, often making funds available within hours or the same day. In contrast, cashier’s checks can take longer since they need to be physically deposited and cleared by the bank.

If you value speed and convenience, wire transfers are typically the way to go. However, some sellers might lean toward cashier’s checks for their physical format and added sense of security. Be sure to check with your closing agent or title company to confirm which method aligns best with your situation.

What risks or delays should sellers be aware of when receiving payment through a cashier’s check?

Receiving a payment via a cashier’s check might seem secure, but it does come with some risks and potential delays. One major concern is fraud – counterfeit or stolen checks can sometimes make their way into circulation. On top of that, banks often place holds on cashier’s checks, especially if the amount is large, to ensure they’re legitimate. This verification process can delay access to your funds and potentially disrupt your closing schedule.

To reduce these risks, always deal with trusted parties and verify the check directly with the issuing bank before moving forward. If you need a quicker and more reliable option, payment methods like wire transfers could be a better choice.